Michael Spelfogel

Co-Founder, President

Build your own Credit Card

Navigating the altitude: How United's steady loyalty path differs from Delta's turbulence

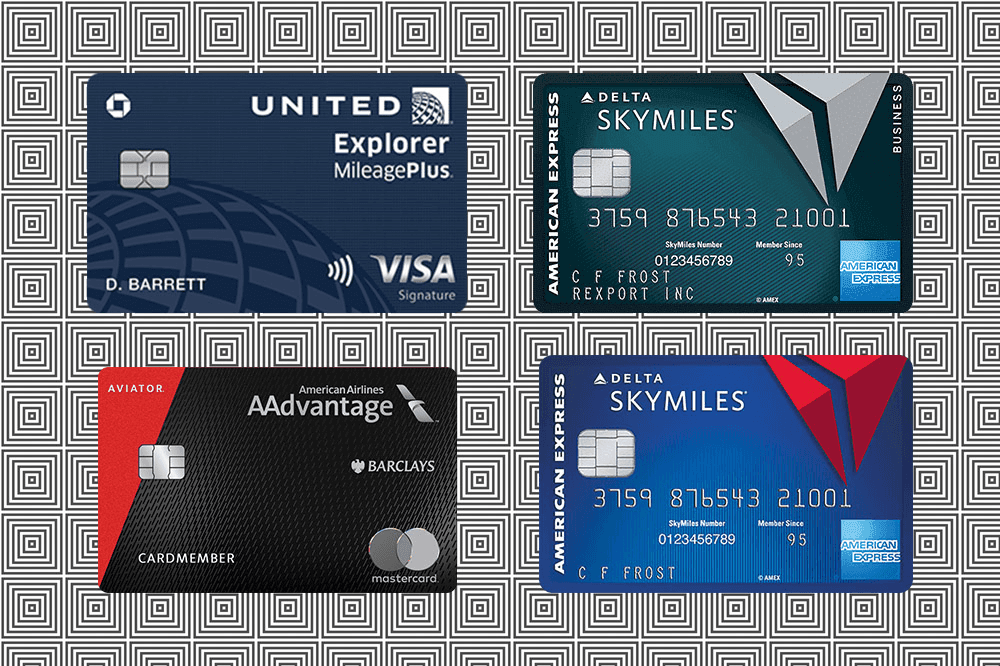

As the holiday travel season approaches, the skies are abuzz with more than just airplanes. United Airlines has recently made a strategic move to maintain its loyalty program qualification levels, a stark contrast to Delta's recent backtrack on their own program's overhaul. This decision comes amidst a broader industry trend, where airlines are reevaluating how "elite status" is granted and leveraged to foster loyalty and brand differentiation. United Airlines' partnership with Chase and its strategic decision to maintain loyalty program levels have sent ripples through the frequent flyer community, contrasting sharply with Delta's recent rollback of its contentious program changes.

United's loyalty program stance

United Airlines has decided to hold steady amid the industry's tumultuous changes, keeping the qualification levels for its loyalty program unchanged. This strategic choice to allow customers to earn top-tier status through credit card spending, especially in partnership with Chase, signals a clear understanding of the market. United's approach is tactically sound; by not raising the qualification bar, they make it effectively easier to earn status compared to Delta for the upcoming year. The move seems to be a calculated response to the market's reaction to changes in loyalty programs, showing that United values consistency and customer loyalty.

Delta's program revisions and backlash

Delta's initial revamp of its SkyMiles program was met with significant consternation. The airline's attempt to address a surge in the ranks of elite frequent flyers led to a dramatic policy shift—basing elite status purely on spending. This change, coupled with restricted club access, caused an uproar among Delta's frequent flyers. In response to the backlash, Ed Bastian, Delta's CEO, conceded, "It’s been a challenge to balance the growth of our membership with our need to deliver premium service experiences... But your response made clear that the changes did not fully reflect the loyalty you have demonstrated to Delta.” Delta has since walked back some of these changes, reducing the spending thresholds for earning Medallion status and increasing club access, a nod to the power of customer feedback and the importance of loyal customers.

The larger industry trend and the role of Cardless

What we're seeing now is a significant shift in how airlines conceptualize elite status within their loyalty programs. United's decision to ease status attainment highlights the incentive for customers to choose their airline and credit card, a crucial competitive edge. Airlines are learning that loyalty program devaluation can lead to adverse consequences, considering the collective clout of average flyers. This is where investing in loyalty becomes not just a strategy but a necessity for differentiation. The amount of spending through airline credit cards, such as the Delta-Amex partnership, underscores the enormous economic impact of these loyalty programs. Cardless steps in at this juncture, offering credit cards that not only understand but cater to the desires and expectations of today's travelers.

The evolution of airline loyalty programs is a telling sign of how critical it is for airlines to align with consumer expectations. The recent changes by United and Delta underscore a fundamental shift in the industry—acknowledging that loyalty and the path to elite status need to be accessible and rewarding. Cardless is at the forefront of this transformation, creating credit cards that promise a loyalty experience that meets the modern traveler's needs. As we gear up for the holiday travel season, it's more important than ever for flyers to assess how their travel and credit card choices reflect their loyalty expectations. And for the airlines, it's a reminder that the heart of loyalty lies in consistent recognition and reward for customer dedication.

Build your own Credit Card

Unlock endless possibilities with our powerful platform to create a program that fits your needs.

Michael Spelfogel

Co-Founder, President

Build your own Credit Card

Navigating the altitude: How United's steady loyalty path differs from Delta's turbulence

As the holiday travel season approaches, the skies are abuzz with more than just airplanes. United Airlines has recently made a strategic move to maintain its loyalty program qualification levels, a stark contrast to Delta's recent backtrack on their own program's overhaul. This decision comes amidst a broader industry trend, where airlines are reevaluating how "elite status" is granted and leveraged to foster loyalty and brand differentiation. United Airlines' partnership with Chase and its strategic decision to maintain loyalty program levels have sent ripples through the frequent flyer community, contrasting sharply with Delta's recent rollback of its contentious program changes.

United's loyalty program stance

United Airlines has decided to hold steady amid the industry's tumultuous changes, keeping the qualification levels for its loyalty program unchanged. This strategic choice to allow customers to earn top-tier status through credit card spending, especially in partnership with Chase, signals a clear understanding of the market. United's approach is tactically sound; by not raising the qualification bar, they make it effectively easier to earn status compared to Delta for the upcoming year. The move seems to be a calculated response to the market's reaction to changes in loyalty programs, showing that United values consistency and customer loyalty.

Delta's program revisions and backlash

Delta's initial revamp of its SkyMiles program was met with significant consternation. The airline's attempt to address a surge in the ranks of elite frequent flyers led to a dramatic policy shift—basing elite status purely on spending. This change, coupled with restricted club access, caused an uproar among Delta's frequent flyers. In response to the backlash, Ed Bastian, Delta's CEO, conceded, "It’s been a challenge to balance the growth of our membership with our need to deliver premium service experiences... But your response made clear that the changes did not fully reflect the loyalty you have demonstrated to Delta.” Delta has since walked back some of these changes, reducing the spending thresholds for earning Medallion status and increasing club access, a nod to the power of customer feedback and the importance of loyal customers.

The larger industry trend and the role of Cardless

What we're seeing now is a significant shift in how airlines conceptualize elite status within their loyalty programs. United's decision to ease status attainment highlights the incentive for customers to choose their airline and credit card, a crucial competitive edge. Airlines are learning that loyalty program devaluation can lead to adverse consequences, considering the collective clout of average flyers. This is where investing in loyalty becomes not just a strategy but a necessity for differentiation. The amount of spending through airline credit cards, such as the Delta-Amex partnership, underscores the enormous economic impact of these loyalty programs. Cardless steps in at this juncture, offering credit cards that not only understand but cater to the desires and expectations of today's travelers.

The evolution of airline loyalty programs is a telling sign of how critical it is for airlines to align with consumer expectations. The recent changes by United and Delta underscore a fundamental shift in the industry—acknowledging that loyalty and the path to elite status need to be accessible and rewarding. Cardless is at the forefront of this transformation, creating credit cards that promise a loyalty experience that meets the modern traveler's needs. As we gear up for the holiday travel season, it's more important than ever for flyers to assess how their travel and credit card choices reflect their loyalty expectations. And for the airlines, it's a reminder that the heart of loyalty lies in consistent recognition and reward for customer dedication.

Build your own Credit Card

Unlock endless possibilities with our powerful platform to create a program that fits your needs.

Michael Spelfogel

Co-Founder, President

Build your own Credit Card

Navigating the altitude: How United's steady loyalty path differs from Delta's turbulence

As the holiday travel season approaches, the skies are abuzz with more than just airplanes. United Airlines has recently made a strategic move to maintain its loyalty program qualification levels, a stark contrast to Delta's recent backtrack on their own program's overhaul. This decision comes amidst a broader industry trend, where airlines are reevaluating how "elite status" is granted and leveraged to foster loyalty and brand differentiation. United Airlines' partnership with Chase and its strategic decision to maintain loyalty program levels have sent ripples through the frequent flyer community, contrasting sharply with Delta's recent rollback of its contentious program changes.

United's loyalty program stance

United Airlines has decided to hold steady amid the industry's tumultuous changes, keeping the qualification levels for its loyalty program unchanged. This strategic choice to allow customers to earn top-tier status through credit card spending, especially in partnership with Chase, signals a clear understanding of the market. United's approach is tactically sound; by not raising the qualification bar, they make it effectively easier to earn status compared to Delta for the upcoming year. The move seems to be a calculated response to the market's reaction to changes in loyalty programs, showing that United values consistency and customer loyalty.

Delta's program revisions and backlash

Delta's initial revamp of its SkyMiles program was met with significant consternation. The airline's attempt to address a surge in the ranks of elite frequent flyers led to a dramatic policy shift—basing elite status purely on spending. This change, coupled with restricted club access, caused an uproar among Delta's frequent flyers. In response to the backlash, Ed Bastian, Delta's CEO, conceded, "It’s been a challenge to balance the growth of our membership with our need to deliver premium service experiences... But your response made clear that the changes did not fully reflect the loyalty you have demonstrated to Delta.” Delta has since walked back some of these changes, reducing the spending thresholds for earning Medallion status and increasing club access, a nod to the power of customer feedback and the importance of loyal customers.

The larger industry trend and the role of Cardless

What we're seeing now is a significant shift in how airlines conceptualize elite status within their loyalty programs. United's decision to ease status attainment highlights the incentive for customers to choose their airline and credit card, a crucial competitive edge. Airlines are learning that loyalty program devaluation can lead to adverse consequences, considering the collective clout of average flyers. This is where investing in loyalty becomes not just a strategy but a necessity for differentiation. The amount of spending through airline credit cards, such as the Delta-Amex partnership, underscores the enormous economic impact of these loyalty programs. Cardless steps in at this juncture, offering credit cards that not only understand but cater to the desires and expectations of today's travelers.

The evolution of airline loyalty programs is a telling sign of how critical it is for airlines to align with consumer expectations. The recent changes by United and Delta underscore a fundamental shift in the industry—acknowledging that loyalty and the path to elite status need to be accessible and rewarding. Cardless is at the forefront of this transformation, creating credit cards that promise a loyalty experience that meets the modern traveler's needs. As we gear up for the holiday travel season, it's more important than ever for flyers to assess how their travel and credit card choices reflect their loyalty expectations. And for the airlines, it's a reminder that the heart of loyalty lies in consistent recognition and reward for customer dedication.

Build your own Credit Card

Unlock endless possibilities with our powerful platform to create a program that fits your needs.

Michael Spelfogel

Co-Founder, President

Build your own Credit Card

Navigating the altitude: How United's steady loyalty path differs from Delta's turbulence

As the holiday travel season approaches, the skies are abuzz with more than just airplanes. United Airlines has recently made a strategic move to maintain its loyalty program qualification levels, a stark contrast to Delta's recent backtrack on their own program's overhaul. This decision comes amidst a broader industry trend, where airlines are reevaluating how "elite status" is granted and leveraged to foster loyalty and brand differentiation. United Airlines' partnership with Chase and its strategic decision to maintain loyalty program levels have sent ripples through the frequent flyer community, contrasting sharply with Delta's recent rollback of its contentious program changes.

United's loyalty program stance

United Airlines has decided to hold steady amid the industry's tumultuous changes, keeping the qualification levels for its loyalty program unchanged. This strategic choice to allow customers to earn top-tier status through credit card spending, especially in partnership with Chase, signals a clear understanding of the market. United's approach is tactically sound; by not raising the qualification bar, they make it effectively easier to earn status compared to Delta for the upcoming year. The move seems to be a calculated response to the market's reaction to changes in loyalty programs, showing that United values consistency and customer loyalty.

Delta's program revisions and backlash

Delta's initial revamp of its SkyMiles program was met with significant consternation. The airline's attempt to address a surge in the ranks of elite frequent flyers led to a dramatic policy shift—basing elite status purely on spending. This change, coupled with restricted club access, caused an uproar among Delta's frequent flyers. In response to the backlash, Ed Bastian, Delta's CEO, conceded, "It’s been a challenge to balance the growth of our membership with our need to deliver premium service experiences... But your response made clear that the changes did not fully reflect the loyalty you have demonstrated to Delta.” Delta has since walked back some of these changes, reducing the spending thresholds for earning Medallion status and increasing club access, a nod to the power of customer feedback and the importance of loyal customers.

The larger industry trend and the role of Cardless

What we're seeing now is a significant shift in how airlines conceptualize elite status within their loyalty programs. United's decision to ease status attainment highlights the incentive for customers to choose their airline and credit card, a crucial competitive edge. Airlines are learning that loyalty program devaluation can lead to adverse consequences, considering the collective clout of average flyers. This is where investing in loyalty becomes not just a strategy but a necessity for differentiation. The amount of spending through airline credit cards, such as the Delta-Amex partnership, underscores the enormous economic impact of these loyalty programs. Cardless steps in at this juncture, offering credit cards that not only understand but cater to the desires and expectations of today's travelers.

The evolution of airline loyalty programs is a telling sign of how critical it is for airlines to align with consumer expectations. The recent changes by United and Delta underscore a fundamental shift in the industry—acknowledging that loyalty and the path to elite status need to be accessible and rewarding. Cardless is at the forefront of this transformation, creating credit cards that promise a loyalty experience that meets the modern traveler's needs. As we gear up for the holiday travel season, it's more important than ever for flyers to assess how their travel and credit card choices reflect their loyalty expectations. And for the airlines, it's a reminder that the heart of loyalty lies in consistent recognition and reward for customer dedication.

Build your own Credit Card

Unlock endless possibilities with our powerful platform to create a program that fits your needs.

Build your own Credit Card

United Airlines retains its loyalty program thresholds in contrast to Delta's turbulent policy changes, reflecting a strategic approach to customer loyalty and market competition.

Michael Spelfogel

Co-Founder, President

Build your own Credit Card

Unlock endless possibilities with our powerful platform to create a program that fits your needs.